Global Energy Portfolio Management Market Expected to Grow at Nearly 11.9% CAGR Through 2034

Market to expand from USD 3.69 billion in 2026 to USD 9.06 billion by 2034 amid rising renewable integration and AI adoption.

Advanced portfolio management solutions are critical for navigating volatility and optimizing diverse energy assets in an era of renewable integration and digital transformation.”

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- The global energy portfolio management market is witnessing notable expansion and is projected to maintain strong growth throughout the forecast period, according to a new market research report published by Fortune Business Insights™. The market was valued at USD 3.29 billion in 2025 and is expected to grow from USD 3.69 billion in 2026 to USD 9.06 billion by 2034, registering a robust compound annual growth rate (CAGR) of 11.9% during this period. This growth trajectory reflects the increasing complexity of global energy systems and the rising need for optimized, data-driven portfolio management solutions.— Fortune Business Insights

Energy portfolio management solutions consist of advanced digital platforms and software tools that support utilities, energy producers, and energy traders in optimizing asset performance, managing operational and financial risks, and improving strategic planning across diverse energy portfolios. These portfolios typically include a mix of renewable energy sources—such as wind and solar—as well as conventional energy assets. As global energy markets become more dynamic and interconnected, organizations are increasingly relying on portfolio management tools to maintain efficiency, profitability, and compliance.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/energy-portfolio-management-market-115207

One of the key factors driving market growth is the growing complexity of energy landscapes worldwide. The integration of renewable energy sources into existing grids has increased operational challenges due to variability in generation and supply. At the same time, energy market volatility—driven by fluctuating demand, regulatory changes, and geopolitical factors—has heightened the need for real-time visibility and informed decision-making. Energy portfolio management systems address these challenges by enabling accurate forecasting, scenario analysis, and risk mitigation.

The expanding adoption of renewable energy is another significant growth driver. Governments and regulatory bodies across regions continue to emphasize decarbonization and clean energy transition, encouraging utilities and producers to diversify energy portfolios. This transition has increased the importance of portfolio optimization tools capable of balancing intermittent renewable generation with conventional energy assets while maintaining grid stability and cost efficiency.

The increasing adoption of cloud-based platforms and advanced analytics technologies, including artificial intelligence (AI) and machine learning, is further strengthening the market’s growth outlook. These technologies enable real-time forecasting, predictive modeling, and enhanced decision-making capabilities. By leveraging advanced analytics, organizations can balance supply and demand more effectively, reduce exposure to market risks, and maximize operational performance across their energy portfolios.

Cloud-based energy portfolio management platforms offer scalability, flexibility, and seamless integration with external data sources, making them particularly suitable for evolving energy markets. These platforms also support continuous updates and real-time monitoring, allowing energy companies to respond quickly to changing market conditions. As digital transformation accelerates across the energy sector, cloud-based solutions are becoming increasingly central to portfolio management strategies.

Market Trends

A prominent trend shaping the energy portfolio management market is the growing integration of renewable energy assets, particularly wind and solar, into energy portfolios. While renewable sources support sustainability goals, their inherent variability and intermittency present operational challenges. This has increased demand for sophisticated forecasting and optimization tools that can manage fluctuating generation patterns and align supply with demand.

Regulatory emphasis on carbon reduction and renewable energy penetration is further accelerating adoption. Energy companies are increasingly required to comply with emissions targets and reporting standards, prompting greater reliance on portfolio management solutions capable of real-time analytics and comprehensive risk modeling. These tools support compliance while also improving operational efficiency.

Another notable trend is the growing use of real-time monitoring and predictive maintenance capabilities. These functionalities help energy producers and grid operators enhance asset reliability, reduce unplanned downtimes, and optimize maintenance schedules. As energy systems become more complex and interconnected, real-time insights are becoming essential for maintaining performance and minimizing operational disruptions.

Market Segmentation

The report segments the energy portfolio management market based on application, deployment type, and solution.

By application, renewable energy management emerged as a leading segment in 2025. The rapid expansion of wind and solar capacity has increased the need for tools that can forecast generation output, manage intermittency, and optimize renewable assets within broader energy portfolios. Portfolio management solutions play a critical role in aligning renewable generation with market demand and supporting efficient energy trading strategies.

From a deployment perspective, cloud-based solutions accounted for the largest share of the market in 2025. The scalability and real-time data processing capabilities offered by cloud platforms make them well suited for dynamic and data-intensive energy environments. Cloud deployment also enables faster system integration, lower infrastructure costs, and improved accessibility for geographically distributed operations.

In terms of solutions, the software segment dominated the market in 2025. Demand for integrated software platforms offering forecasting, optimization, and risk management functionalities continues to rise. These platforms provide energy companies with real-time visibility into portfolio performance, enabling scenario modeling, strategic planning, and informed decision-making across diverse asset types.

Buy This Exclusive Report: https://www.fortunebusinessinsights.com/select-license/115207

Regional Insights

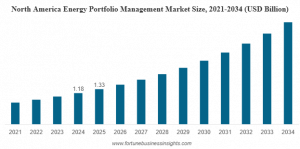

Regionally, North America held the largest share of the global energy portfolio management market in 2025, with a market value of USD 1.33 billion. The region benefits from a mature energy trading ecosystem, extensive renewable energy deployment, and early adoption of advanced digital energy management platforms. Utilities and energy traders in North America increasingly rely on analytics-driven optimization tools to navigate market volatility and meet regulatory requirements.

The Asia Pacific region represents a significant growth opportunity for the market. Rapid expansion of renewable energy capacity, rising electricity demand, and growing investments in digital energy infrastructure are driving adoption across the region. Countries such as China, Japan, and India are showing increasing interest in portfolio management solutions to enhance forecasting accuracy, improve operational efficiency, and manage complex energy systems.

Other regions, including Europe, South America, and the Middle East & Africa, are also witnessing gradual adoption of energy portfolio management tools. In these regions, utilities and energy producers are focusing on decarbonization initiatives, cross-border energy trading, and diversification of energy assets, further supporting demand for advanced portfolio management solutions.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.