CEO and C-Suite ESG Priorities for 2026

Drawing on The Conference Board® C-Suite Outlook 2026 global survey of business leaders, this report analyzes how CEOs and CSuite executives in Europe, North America, and globally are recalibrating environmental, social & governance (ESG) priorities for 2026 amid heightened disruption, uncertainty, and execution risk.

Trusted Insights for What’s Ahead®

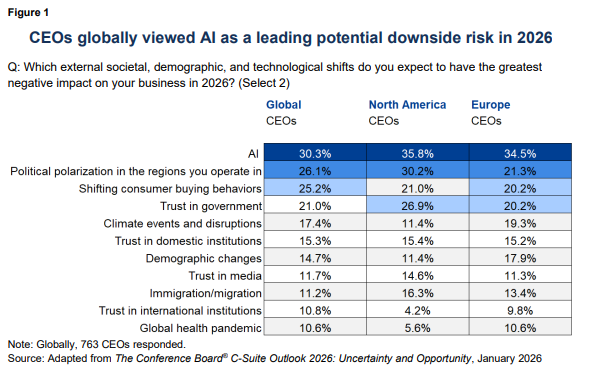

- CEOs globally ranked AI as the leading societal or technological shift expected to negatively impact their business in 2026—ahead of political polarization and shifting consumer behaviors—as leaders grapple with scaling new technologies amid regulatory volatility and societal disruption.

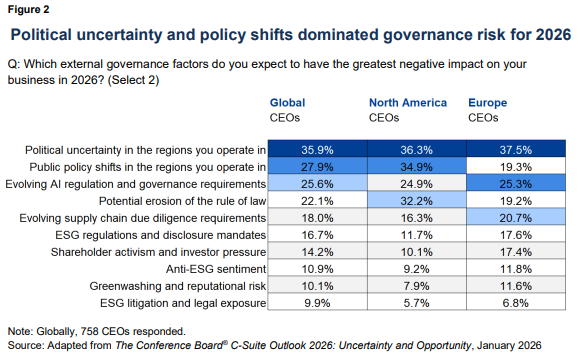

- CEOs globally ranked political uncertainty and public policy shifts as key external governance factors expected to impact business in 2026, with many planning for sustained policy volatility, institutional fragility, and rising AI governance and regulatory complexity.

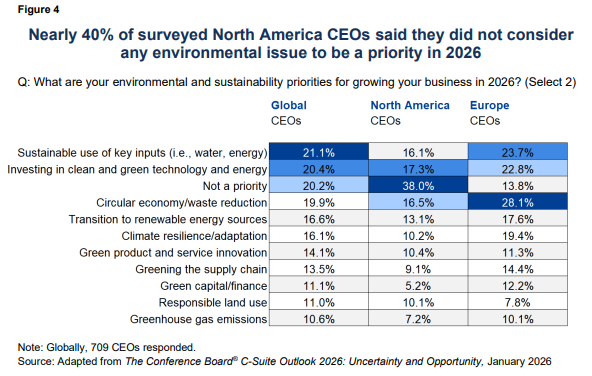

- CEOs’ environmental priorities diverged sharply by region, with a significant share of North America’s leaders deprioritizing sustainability issues altogether while others emphasized resource efficiency and advancing clean technology tied to competitiveness.

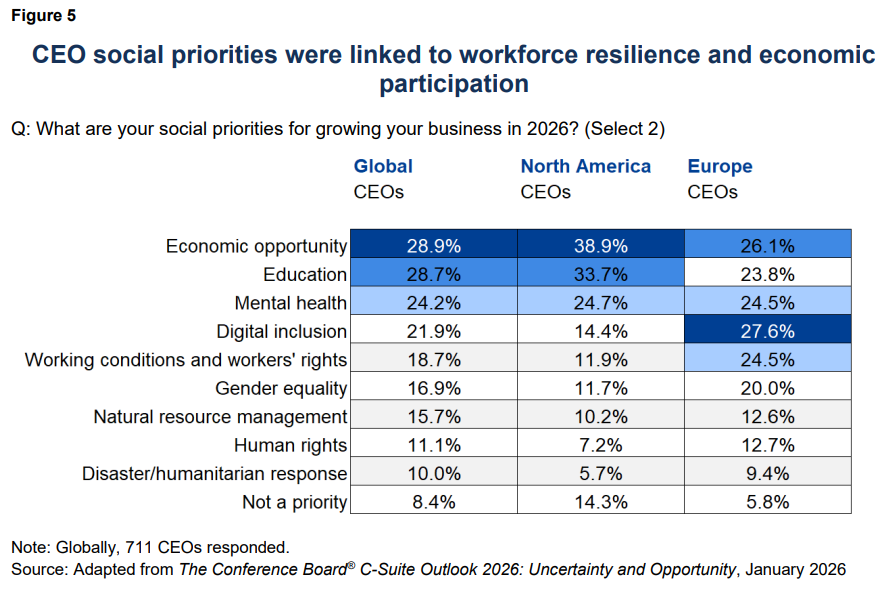

- Social priorities in 2026 were anchored strongly in workforce resilience, with CEOs prioritizing education, economic opportunity, and mental health as top enablers of growth and execution.

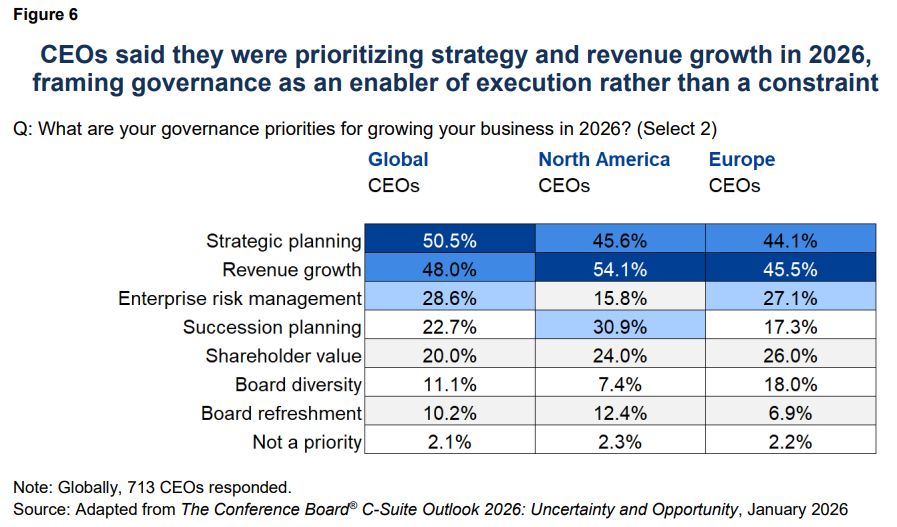

- Governance priorities for 2026 reflected an emphasis on performance alongside compliance, with CEOs and C-Suite executives elevating strategy execution and revenue growth while continuing to address established governance areas such as enterprise risk management and succession planning.

|

The Conference Board® C-Suite Outlook 2026

Since 1999, The Conference Board has surveyed CEOs—and later the broader CSuite—globally to identify their most critical challenges and strategies. The anonymous survey was carried out from October 10, 2025 to November 24, 2025, with 1,732 CSuite executives responding, including 771 CEOs from around the world. Respondents were asked about external risks, internal constraints, growth and profitability priorities, expansion plans, and the integration of AI, sustainability, workforce resilience, and governance into core business strategy. |

External Societal, Demographic, and Technological Risks

Globally, “AI” stands out as the most frequently cited societal, demographic, and technological downside risk for 2026 across CEOs (30.3%), the broader C-Suite (37.8%), and board members (39.2%). This does not signal diminished confidence in AI’s strategic value, but instead reflects concerns that execution, governance, and organizational readiness are lagging the pace of adoption, posing material risks. Leaders are grappling with uneven returns on investment, persistent skills gaps, evolving regulation, data governance requirements, and the challenge of scaling AI in ways that preserve trust, accountability, and operational stability. In effect, AI has shifted from a growth opportunity to a governance stress test.

“Political polarization in the regions you operate in” emerged as a closely related second-tier risk, particularly in North America, where declining trust in government and institutions amplifies uncertainty. CEOs increasingly operate in a complex policy environment—characterized by frequent regulatory shifts, reversals, and reinterpretations that raise the likelihood that routine business decisions will be scrutinized through partisan or ideological lenses. For many leaders, this represents a structural change rather than a cyclical disruption, reinforcing the need for faster regulatory sensing, clearer internal documentation of decision-making, and more robust scenario planning for jurisdictional divergence.

“Climate events and disruptions” remained material in 2026 planning, especially in Europe and in climate-exposed sectors, but they ranked below AI and political polarization in near-term executive attention. This ordering likely reflects triage under constraint: immediate governance and societal volatility are pulling focus toward issues perceived as more acute and harder to manage in the short term. Physical climate risks will continue to intensify and accumulate over the medium term, even where they are not the dominant driver of near-term planning.

Governance Factors

According to surveyed CEOs, external governance risk in 2026 will be shaped less by isolated shocks than by sustained political and institutional uncertainty. In North America, this uncertainty is driven by policy reversals, legal exposure, and declining confidence in institutional predictability. In Europe, it reflects the combined effects of dense regulatory frameworks and uncertainty surrounding recent efforts to recalibrate or deregulate elements of the policy regime amid geopolitical strain.

“Public policy shifts in the regions you operate in” and “potential erosion of the rule of law” were also cited as negative potential external governance factors, reflecting uncertainty over regulatory durability, interpretation, and enforcement. In the United States in particular, CEOs are attuned to further potential erosion in the rule of law and whether governance frameworks will hold and enforcement will be evenhanded. Meanwhile, CEOs in Europe place greater emphasis on regulatory burdens—particularly ESG disclosure mandates and supply chain due diligence requirements.

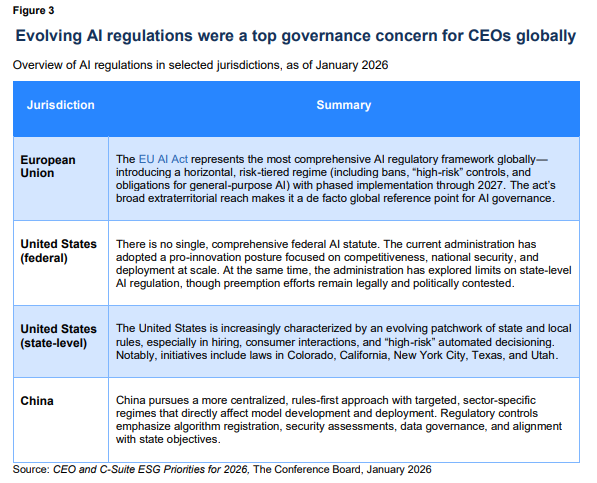

Notably, “evolving AI regulation and governance requirements” ranked alongside traditional governance risks, reflecting both AI’s integration into core business operations and the rapid proliferation of new legal and policy frameworks. The challenge is not just AI regulation itself, but regulatory uncertainty: rules are emerging unevenly across jurisdictions, enforcement expectations remain fluid, and definitions of risk, responsibility, and acceptable use continue to evolve (Figure 3). This ambiguity can complicate investment decisions, slow deployment at scale, and increase the risk of inconsistent compliance across markets.

No region was particularly concerned about anti-ESG sentiment, which ranked well below concerns about enforceability, liability, and institutional coherence.

Environmental and Sustainability Priorities

Environmental priorities for 2026 were pragmatic and uneven. Unlike governance and technology, where executive attention is converging, environmental sustainability showed wide dispersion across regions, sectors, and company size. A notable share of CEOs also reported that environmental issues were not a near-term growth priority.

This trend was most pronounced in North America, particularly in the United States, where 38.4% of CEOs said environmental issues were “not a priority” for growing their business in 2026—well above Europe and much of Asia. This likely does not reflect declining awareness of climate or environmental risk, but rather a recalibration shaped by political polarization, heightened legal scrutiny of ESG claims, and uncertainty around regulatory expectations. In this context, some executives view public sustainability commitments as carrying reputational and litigation risk, especially where regulatory expectations are less prescriptive than in Europe.

Company size further differentiated priorities. CEOs at large firms (revenues above $1 billion) were more likely to emphasize clean and green technologies, circular economy initiatives, and renewable energy, with the share responding that environmental sustainability is “not a priority” falling to 10.9% globally. However, even among large US companies, 21.3% of CEOs still reported that environmental issues were not central to their growth plans.

Across regions and sectors, the composition of environmental priorities has also shifted. Resource efficiency, circularity, and clean technology investment consistently outranked greenhouse gas (GHG) emissions reduction, likely reflecting a move away from aspirational targets toward levers directly tied to cost control, operational resilience, and competitiveness. The relatively lower emphasis on GHG emissions reduction may also reflect a degree of maturity: for many large companies, emissions management is already embedded in energy, efficiency, and renewables strategies and increasingly treated as a compliance baseline rather than a near-term growth differentiator.

CEOs in Europe presented a more balanced sustainability profile. With relatively fewer (13.8%) saying environmental issues were “not a priority,” attention was spread across efficiency, circular economy models, and clean technologies. This likely reflects Europe’s more prescriptive regulatory environment and higher energy costs, which make environmental performance a strategic and financial necessity rather than a discretionary initiative.

Social Priorities

C-Suite social priorities for 2026 were closely tied to workforce resilience and long-term growth. Education and economic opportunity ranked at the top, continuing a multiyear trend driven by persistent concerns about workforce readiness, skills mismatches, and labor availability. These priorities also reflect growing recognition of the link between inclusive economic participation and sustained demand. The emphasis was pronounced among North America CEOs, with US leaders in particular viewing “economic opportunity” as a core business concern (40.1%).

“Mental health” also emerged as a high social priority for CEOs and the C-Suite. Its prominence likely reflects sustained workforce stress, uneven labor market conditions, and growing recognition of the links between well-being, productivity, retention, safety, and leadership effectiveness.

By contrast, values-driven social issues such as “human rights” and “gender equality” were selected less frequently than priorities directly tied to workforce performance and economic participation. CEOs appeared to be placing greater emphasis on areas with immediate operational relevance and clearer lines of accountability, while approaching broader normative issues with greater caution amid heightened legal, political, and reputational scrutiny, especially in North America.

Regional differences reinforce this interpretation. Europe CEOs placed greater emphasis on “digital inclusion” and “working conditions and workers’ rights,” reflecting stronger labor protections and social safety nets where the corporate role is less about access and more about quality of work and workforce sustainability. In North America, priorities were shaped more by sustained concerns about participation, mobility, and skills alignment.

Notably, fewer CEOs (8.4% globally, 14.3% in North America, 5.8% in Europe) reported that social issues were “not a priority” compared with environmental concerns. Social factors appear to be more consistently embedded in business strategy, reinforcing the view that leaders see investments in people as more immediately relevant to growth and competitiveness in 2026.

Governance Priorities

Governance priorities for 2026 focused on performance and execution. Across regions, CEOs overwhelmingly prioritized “revenue growth” and “strategic planning,” signaling that they view governance not just as a compliance function, but also as an enabler of growth in a complex operating environment. This trend was most pronounced in North America, where a majority of CEOs—particularly in the United States—ranked “revenue growth” well ahead of “enterprise risk management,” even as political, regulatory, and societal volatility remain elevated.

“Enterprise risk management,” “succession planning,” and “shareholder value” formed a second tier of governance priorities. Compared with peers elsewhere, North America CEOs placed relatively less emphasis on “enterprise risk management” and greater emphasis on “succession planning,” likely reflecting heightened sensitivity to leadership continuity and execution risk. Europe CEOs paired strong emphasis on “strategic planning” and “revenue growth” with comparatively higher attention to “enterprise risk management,” reflecting a denser regulatory landscape and greater exposure to geopolitical and supply chain disruption.

Board composition issues—particularly “board diversity” and “board refreshment”—ranked materially lower. They remained part of the governance agenda but were not generally viewed as near-term levers for performance. Recent data from The Conference Board reinforces this interpretation: board turnover has slowed, most US public companies made no new director appointments in the past year, and average director tenure continues to rise. Rather than accelerating refreshment, boards are evolving through selective, skills-based additions— particularly in technology, cyber risk, human capital, and international markets.

Conclusion

The corporate governance and sustainability landscape in 2026 will be defined less by ambition setting than by execution under constraint. Unlike earlier periods—when ESG efforts were shaped by expanding commitments, voluntary frameworks, and reputational signaling—today’s environment is marked by persistent volatility, rising AI-driven complexity, and sharper legal, regulatory, and institutional scrutiny. For CEOs and the C-Suite, the central challenge in 2026 is not whether to engage on ESG, but how to do so selectively and with discipline—tightening oversight, prioritizing material risks and opportunities, and ensuring that governance and sustainability efforts reinforce trust, resilience, and long-term value creation in a fragmented and uncertain operating environment.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.